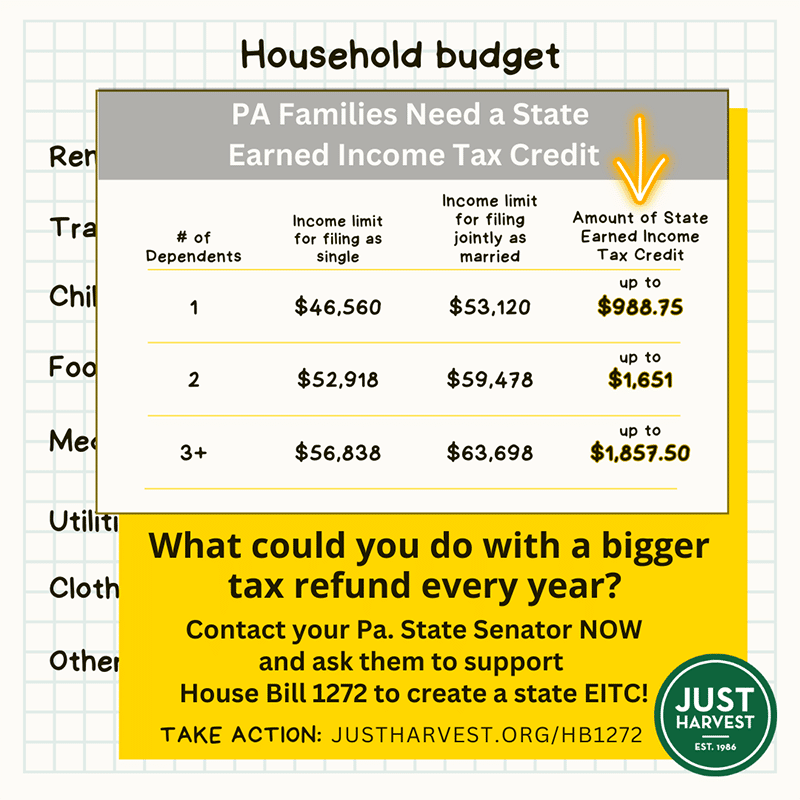

Pennsylvania Senate Should Pass A State Earned Income Tax Credit

The plan includes 33 billion to partly extend a major expansion of the child tax credit that was initially. The amount would rise to 1900 in 2024 and 2000 in 2025 The bill would also ensure the child tax..

Qualifying Child for the CTC The child is your son daughter stepchild eligible foster child brother sister stepbrother. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children. Learn how the Child Tax Credit works if you qualify how to claim it and what additional credits you may. The Child Tax Credit CTC is one of the most important tax cuts for working families in more than a..

. We have updated the rates for Working Tax Credit Child Tax Credit Child Benefit and Guardians Allowance for the 2022 to 2023 tax year 6 April 2021 Rates allowances and duties. To get the maximum amount of child tax credit your annual income will need to be less than 18725 in the 2023-24 tax year up from 17005 in 2022-23. THE TAX CREDITS CHILD BENEFIT AND GUARDIANS ALLOWANCE UP-RATING REGULATIONS 2022 2022 No Introduction 11 This explanatory memorandum has been prepared by. Making a new claim for Child Tax Credit Child Tax Credit will not affect your Child Benefit You can only claim Child Tax Credit for children youre..

You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. Page Last Reviewed or Updated IR-2021-130 June 22 2021 The Internal Revenue Service today launched two new online tools designed to help families. The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are. The Child Tax Credit program can reduce the Federal tax you owe by 1000 for each qualifying child under the age of 17 Important changes to the Child Tax Credit will help many families receive. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account Sign in to your account You can also refer to Letter 6419..

Child Care Creation And Expansion Tax Credit Division Of Child Care Services Office Of Children And Family Services

Comments